virginia estimated tax payments due dates 2021

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000.

Maintenance Activity How To Create A Maintenance Activity Download This Maintenance Activity Template Now Stormwater Management Templates Activities

A change in income deductions or exemptions may require you to file an estimated payment later in the year.

. Is still due April 15. Quarterly The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. At present Virginia TAX does not support International ACH Transactions IAT.

Directly from your bank account direct debit. 1 2022 if you file by mail without a late filing. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. First quarter 2021 estimated tax payments are still due may 1.

Virginia estimated tax payments due dates 2021. Returns are due the 15th day of the 4th month after the close of your fiscal year. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021.

You have until Monday May 2 2022 to submit your return. Give Form W-4 to your employer. 15 de dezembro de 2021.

Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15 2021 September 15 2021 and January 15 2022. Enough to require making estimated income tax payments as of May 1 2021 a change in income may require you to file later in the year. 11 2021 and up to June 15 2021 can now be paid on or before June 15 2021.

Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds. Estimated tax payments must be sent to the Virginia Department of Revenue on a quarterly basis. West Virginia Code 16A-9-1 d Sales and Use Tax CST-200CU Sales and Use Tax Return Instructions Import Spreadsheet Monthly Fourth Quarter and Annual.

Property Tax Due Dates In Alexandria Va PRFRTY. Make tax due estimated tax and extension payments Business Taxes Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes Payment Options Based on the type of payments you want to make you can choose to pay by these options. Typically most people must file their tax return by May 1.

Filing Extensions Cant file by the deadline. Virginia estimated tax payments due dates 2021 Thursday May 12 2022 Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15. Daihatsu fourtrak for sale northern ireland Área do Aluno.

Aligning Virginias filing and payment deadline with the federal government will. Somoza family net worth. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

- Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soon. Loonatics unleashed reboot. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty.

Estimated tax payments due on or after Feb. October 27 2020 October 27 2020 Leave a Comment. Please enter your payment details below.

11 2021 and up to june 15 2021 can now be paid on or before june 15 2021. RICHMOND Governor Ralph Northam today announced that he is directing the Department of Taxation to extend the individual income tax filing and payment deadline in Virginia from Saturday May 1 2021 to Monday May 17 2021. This extension aligns Virginia with the recent announcement from the United States Department of the Treasury and the Internal Revenue Service that federal income tax filings and payments would be extended from Thursday April 15 2021 to Monday May 17 2021.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Savings. We last updated the VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in January 2022 so this is the latest version of Form 760ES fully updated for tax year 2021.

31 2021 can be e-Filed together with the IRS Income Tax Return by April 18 2022If you file a tax extension you can e-File your Taxes until October 15 2022 and Nov. Due dates for 2021 estimated tax payments. This includes estimated extension and return payments.

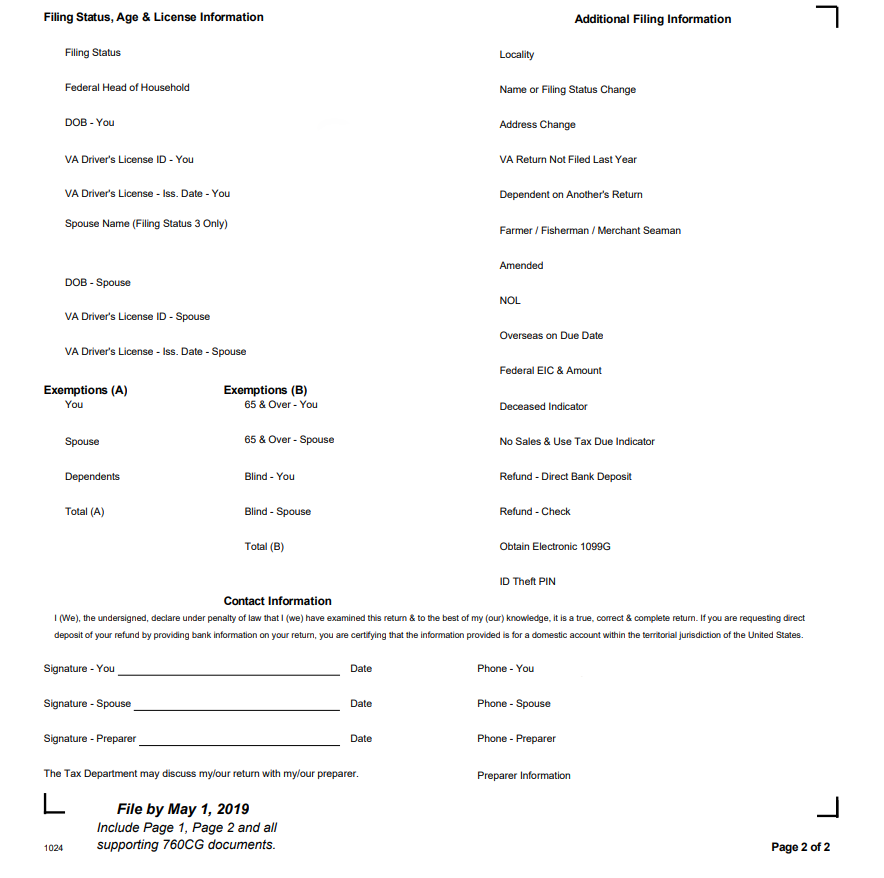

If you later determine that you need to file see the PAYMENT SCHEDULE. The 2021 Virginia State Income Tax Return for Tax Year 2021 Jan. 15 de dezembro de 2021.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Virginia estimated tax due dates 2021. Virginia estimated tax due dates 2021.

Excise Tax CDT Cannabis Dispensary Tax - File through MyTaxes. Virginias Individual Income Tax Filing and Payment Deadline is Monday May 2 2022 FOR IMMEDIATE RELEASE April 18 2022 RICHMOND Va. First quarter 2021 estimated tax payments are still due May 1.

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due April 15 2020 can be made any time on or before June 1 2020 without penalty.

Affordable Electric Rates Virginia Dominion Energy

Where S My Refund Virginia H R Block

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

Pay Online Chesterfield County Va

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

1099 G 1099 Ints Now Available Virginia Tax

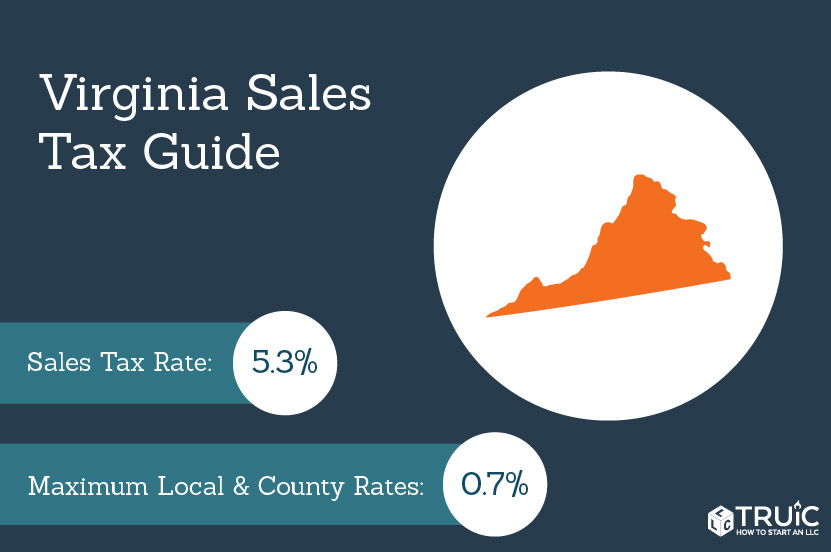

Virginia Sales Tax Guide And Calculator 2022 Taxjar

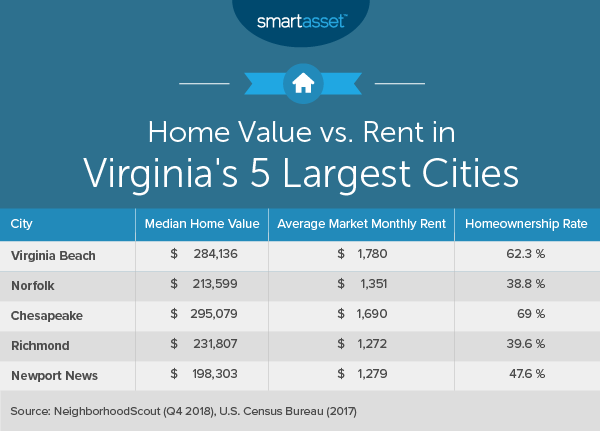

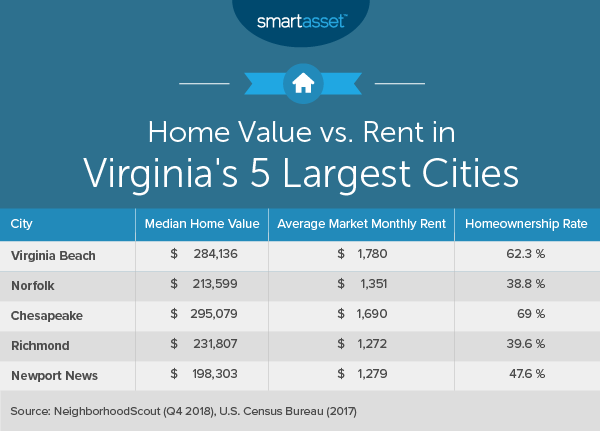

What Is The Cost Of Living In Virginia Smartasset

Instructions On How To Prepare Your Virginia Tax Return Amendment

Virginia Sales Tax Small Business Guide Truic

Virginia Dpb Frequently Asked Questions

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Virginia Dpb Frequently Asked Questions

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

2022 Va Disability Pay Rates Veterans Guardian Va Claim Consulting

Virginia State Taxes 2022 Tax Season Forbes Advisor

Cemeteries In Charlotte County Virginia Find A Grave County Instagram Tutorial Virginia

Home Loan Calculator For Texas Veterans Veteran Home Loan Calculators For Multi State Calculator Vac Mortgage Loan Calculator Va Loan Calculator Va Loan