nj tax sale certificate

Requirements NJSA 4626A NJSA 545 1. The delinquencies will be subject to interest and charges as set forth by the state of New Jersey.

Sales subject to current taxes.

. The sale of a tax lien on a property does not give the purchaser of the certificate any rights of ownership or to trespass on the property. It is the responsibility of the bidder to record their lien with the county after they receive the certificate. Foreclosure right of redemption recording of final judgment.

Purchasers of tax sale certificates liens. By posting this notice the State of New Jersey neither recommends nor discourages investment in tax sale certificates and makes no guarantee of profit or positive result from such investment. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services.

36 months from the date of the tax lien sale Create an assignment of the county rights in the tax lien sale certificate. Sales and Use Tax. Tax sale certificates require active follow up and management by the investor.

Motor Vehicle Sales and Use Tax Exemption Report. New Jersey is a good state for tax lien certificate sales. In New Jersey property taxes are a continuous lien on the real estate in the full annual amount as of the 1stof the year.

Fill out a simple online application form now and receive it within 5 business days. Ad Sales Tax Resale Certificate Nj Wholesale License Reseller Permit Businesses Registration. Name of the tax.

Tax Sale Certificates are recorded in County Clerks Office. So in the above case we can pretend 10000 in taxes were due to the city. Business Tax Clearance Certification Required for Receiving State Grants Incentives.

However if someone would like to purchase them they must contact the Municipal Tax Assessors office in the city of interest. Ad Provide your business with the necessary permits to be successful. Form SC-6 Salem County Energy Exemption Certificate.

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. If a bid made at the tax sale meets the legal requirements of the Tax Sale Law the municipality must either sell the lien or outbid the bidder. By selling off these tax liens municipalities generate revenue.

In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales. Tax Sale Tax Sale Any Municipal taxes or charges such as sewer service charges that are delinquent from the prior year will be subject to tax sale in the current year. The tax sale can be held at any time after April 1st.

So now there could be a tax sale certificate sale that would place a lien on the house because of a previously held New Jersey Tax Sale Certificate Auction. Sales Tax Resale Certificate Nj Simple Online Application. Sales and Use Tax.

A cover sheet or electronic synopsis. Effective January 1 2018 the New Jersey Sales and Use Tax rate decreases from 6875 to 6625. The tax lien sale certificate will show the assignee the first date that they would be entitled to a tax deed to the property.

Sales and Use Tax. The municipality will issue a tax sale certificate to the purchaser who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien. New Jersey Tax Deed Sales New Jersey does have tax deed sales.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. February 1 May 1 August 1 and November 1. Aircraft Dealer Sales and Use Tax Exemption Report.

Resale Certificate for Non-New Jersey Sellers. A lienholder may begin to foreclose on the property two years after the purchase of the tax sale certificate. After the Tax Sale After the sale the tax collector will issue tax sale certificates to the proper bidders within 10 days of the close of sale.

Here is a summary of information for tax sales in New Jersey. Sales and Use Tax. Sales Tax Rate Change.

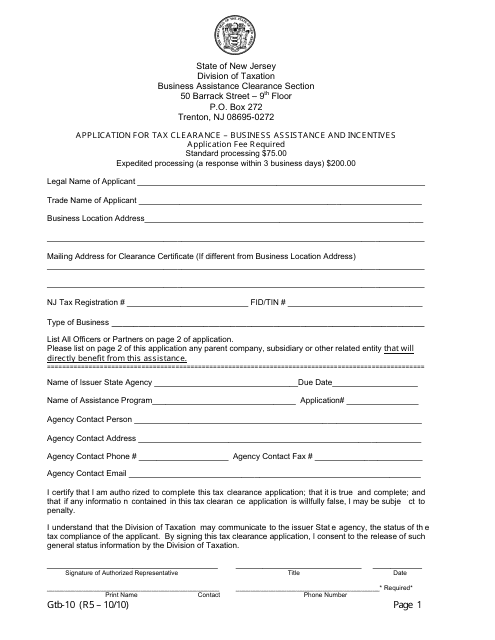

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. Methods of sale of certificate of tax sale by municipality. The tax rate was reduced from 7 to 6875 in 2017.

Anyone wishing to bid must register preceeding the tax sale. This is acquired by the foreclosure process. Assignment Certificate or Assignment of Rights Form Sign and seal this form.

Sale of certificate of tax sale liens by municipality. In New Jersey every municipality is required by law to hold sales of unpaid property taxes at least once each year. Third parties and the municipality bid on the tax sale certificates TSC.

Sales and Use Tax. The municipalities sell the tax liens to obtain the tax revenue which they should have been paid by the property owner. Tax liens are also referred to as tax sale certificates.

The city would auction off that debt and a tax sale certificate would be issued. Property taxes are payable in four installments. Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges.

Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale. Redemption Period 2 years New Jersey Tax Lien Auctions Dates of sales vary depending on the municipality. Tax sales are conducted by the tax collector.

Every New Jersey municipality is authorized by statute to conduct public tax sales due to the non-payment of real estate taxes by the property owner. All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. The municipal tax collector conducts the sale which allows third parties and the municipality itself to bid on the tax sale.

Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality. New Jersey Tax Sale Law Gives Purchaser of a Tax Sale Certificate a Tax Lien on the Underlying Property The court found that as a matter of legislative intent a tax sale certificate secures the obligation to pay municipal taxes thus creating a tax lien. Further additional assignments.

Thus when you pay your taxes. The fill in cover sheet form is available at this link. Additional information about the Sales and Use Tax rate change is available.

Interest Rate 18 or more depending on penalties. New Jersey 08210-5000 Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate.

Jared Cucci Director Of New Jersey Tax Lien Acquisitions And Servicing Bala Partners Llc Linkedin

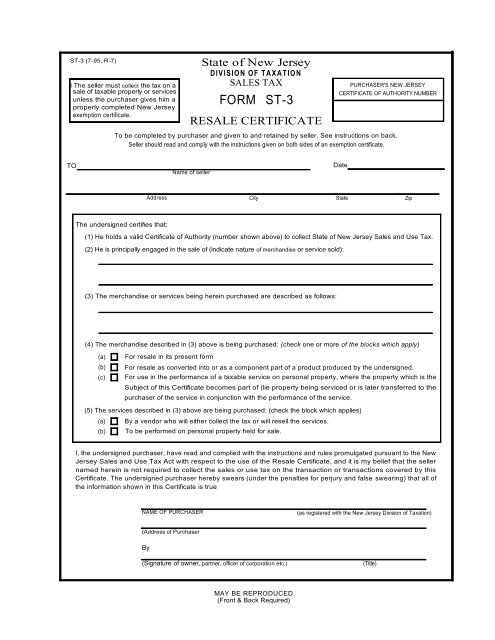

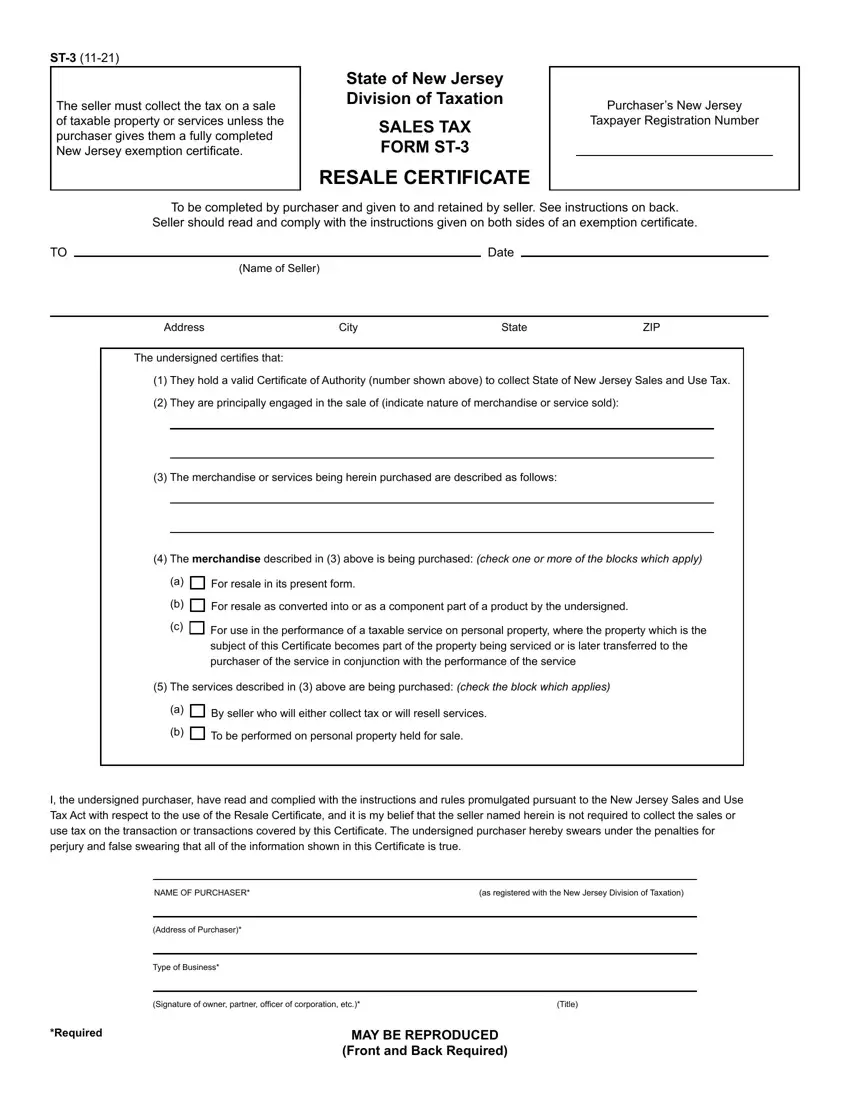

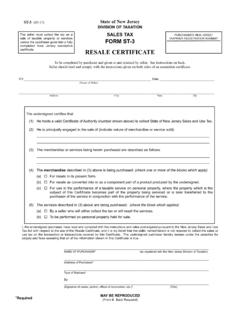

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Texas Sales And Use Tax Exemption Certification Blank Form With Regard To Sales Cert Letter Templates Certificate Templates Certificate Of Achievement Template

Form Gtb 10 Download Fillable Pdf Or Fill Online Application For Tax Clearance Business Assistance And Incentives New Jersey Templateroller

How To Register For A Sales Tax Permit In New Jersey Taxvalet

New Jersey Division Of Taxation Letter Sample 1

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro

Johnson Johnson On Twitter Johnson And Johnson Johnson Stock Certificates

Gloucester City Tax Sale Information Gloucester City Nj

Explore Our Free Eviction Notice Template Nj Eviction Notice Being A Landlord Templates

American Express Stock Certificate Stock Certificates American Express Dow Jones Index